Credit Union brands take note.

There is a huge opportunity for credit unions to invest in a brand transformation initiative to more meaningfully connect with people and communities.

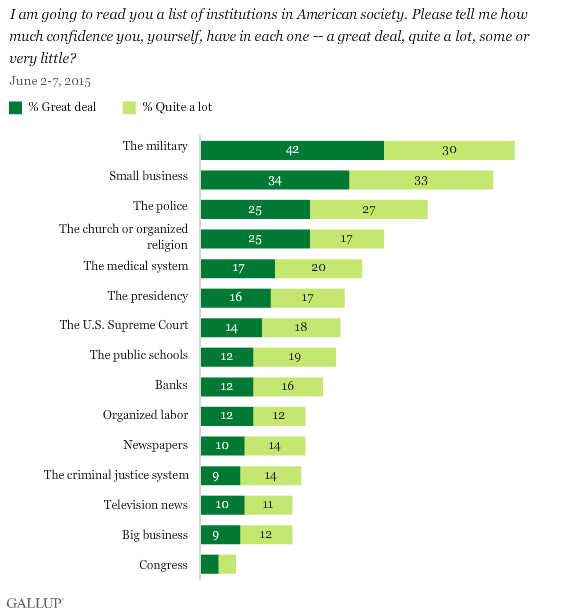

According to Gallup more than 70% of people are customers of a bank, yet only 30% have confidence in banks.

The key question comes down to why?

Perhaps it’s because we feel like we’re just a customer at a bank. And banks make profit from their customers. Profit is their purpose — the answer to the question of why they exist.

The mission of credit unions is different. The purpose of credit unions is to meet their members’ needs. As not-for-profits, they make decisions that benefit members.

In fact, the number of credit unions is growing and credit unions are slowly gaining market share. And the credit unions enjoying the biggest gains are going beyond the low fees and higher rates value proposition, embracing a bigger purpose-centered strategy centered on enhancing the quality of life of their members.

These innovative credit unions are winning because they are creating ways to make their powerful purpose a reality. A growing body of research has proven that achieving financially health is critical and central to our overall wellbeing and quality of life. These credit union realize that their difference isn’t just about better value on credit, savings and investment products. It is about being members’ partner – a partner in achieving financial health – that isn’t trying to profit from you, one that is fully dedicated to helping you make smarter choices and achieve a better quality of life. Credit unions make customers feel like they aren’t just customers, but real human-beings that care about financial well-being.

How credit unions are differentiating themselves from banks is powerful and meaningful, but unfortunately not well understood. A study by the Credit Union National Association reports that more than half of Americans are unclear about what credit unions offer or if they are even eligible as a member.

What does this gap mean? It is time for credit unions to do a better job of bringing their brand purpose and difference to life.

Exceptional companies know people make decisions based on both emotion and logic. They deliver what matters most to people, and that’s never just convenience, it’s meaning. Successful companies emote and express their meaning at every brand touch point.

It’s time for credit union brands to re-invigorate themselves with new urgency and meaning in order to stand out. Credit unions aren’t banks. They don’t just offer convenience at the cost of high fees and low returns. It’s time for credit unions to position themselves as powerful alternatives that offer people something to buy into. It’s time for credit union to get serious about their branding and make a bigger impact with their members and their communities. Credit unions are a win, win, for everyone and should brand themselves as such.

Emotive Brand is a San Francisco brand transformation agency.